How to Read and Understand a Credit Report

If you've already activated your account and are wondering how to read and understand a credit report, don't worry.

It is very easy!

(As you may know, the credit bureaus require a site inspection on the landlord's place of business before allowing access to full credit reports. If this has been something holding you back from getting full reports or if you just are not familiar with what it is, click here for more info. It's no big deal.)

We've dissected a TransUnion credit report to show you one section at a time the components and what they mean.

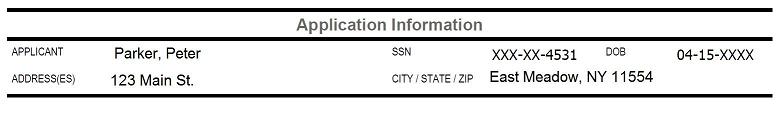

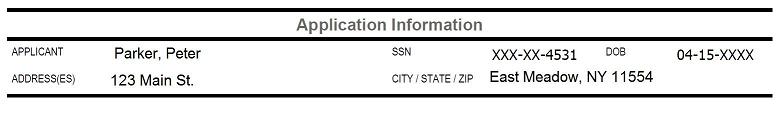

Section 1: The first section of a TransUnion Credit Report, is "Applicant Information".

This should be checked against the applicant information on your rental application.

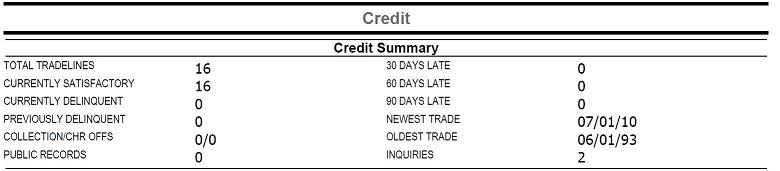

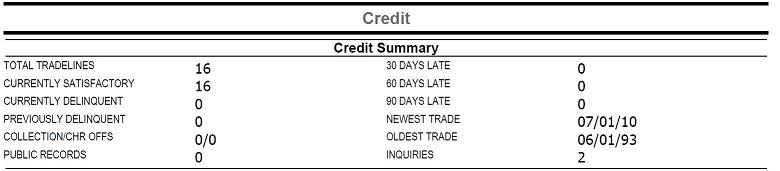

Section 2: The "Credit Summary" is a brief breakdown of the credit report account (tradeline) statistics.

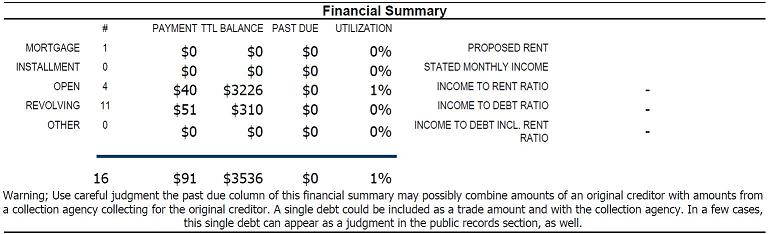

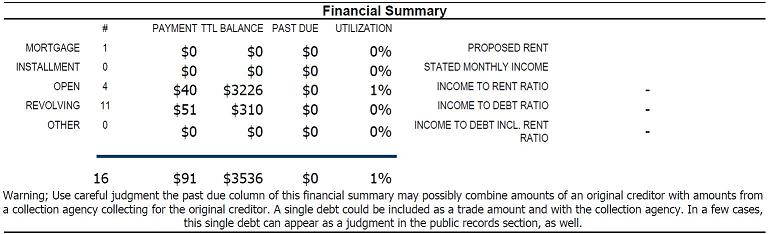

Section 3: The "Financial Summary"summarizes the monetary statistics regarding balances, payments, past due, etc. This can give you a quick idea of how much is owed and what the applicant's monthly payments are.

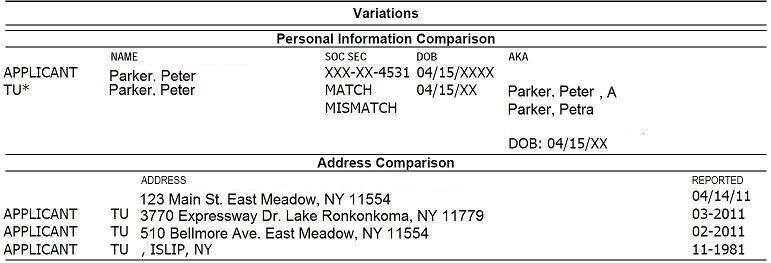

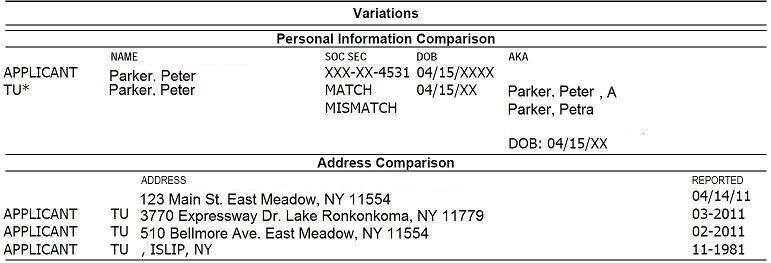

Section 4: "Variations" on "Personal Information Comparison" and "Address Comparison" allows you to explore any variations in the applicant's name and address as it has been reported over the years to the credit bureaus. It will show you aliases, a/k/a's and past addresses as applicable..

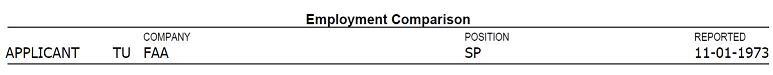

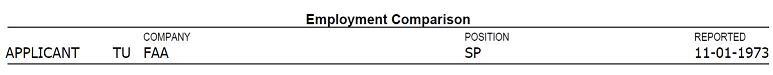

Section 5: "Employment Comparison" will show you a history of employment for this applicant as it was reported to the credit bureaus over the years.

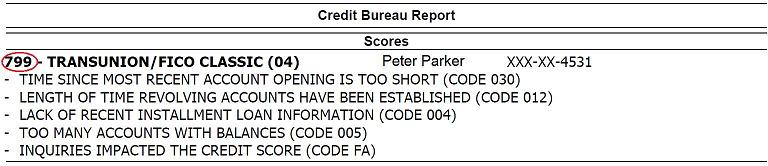

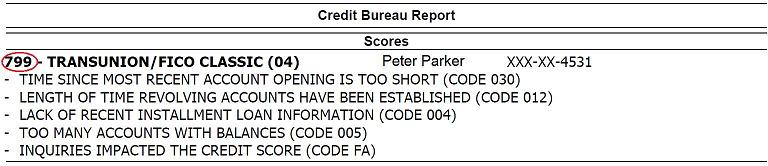

Section 6: Credit Score A TransUnion / FICO score is included in credit reports from Quick Check. A FICO Score is a number calculated from different credit data in a credit report. The percentages of payment history, amounts owed, length of credit history, new credit, and types of credit used determine someone’s FICO score. The FICO Score is a popular way many landlords and banks determine someone's creditworthiness, but a landlord should consider more information than a score to qualify a potential tenant!

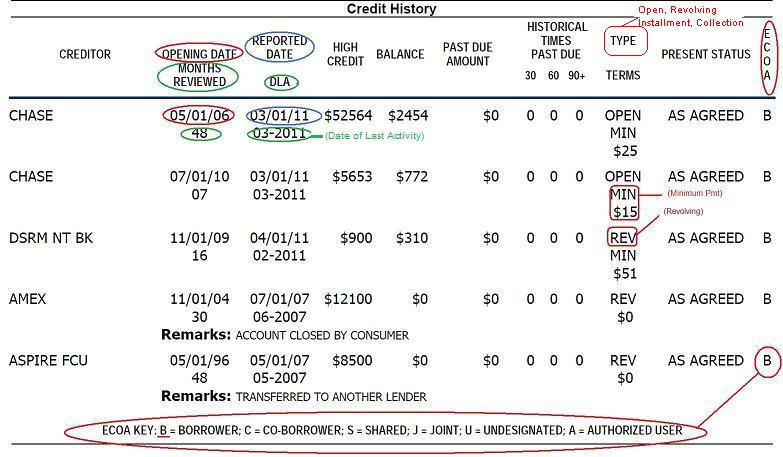

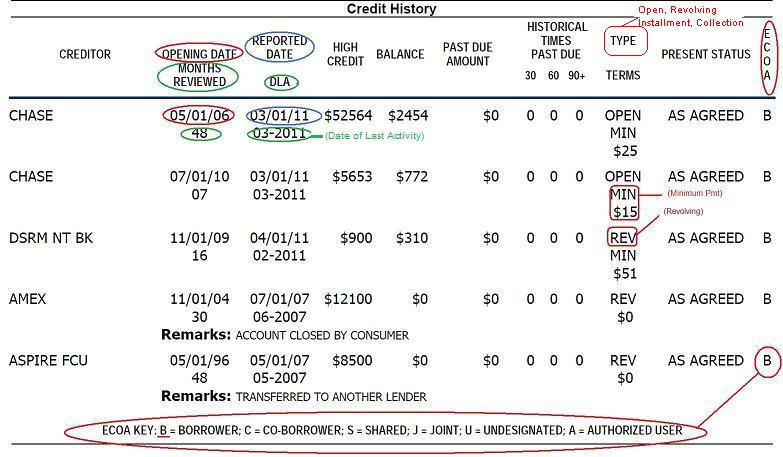

Section 7: Credit History

The credit history section will list the details of each of the applicants established credit accounts. It will include the name of each creditor, type of account, dates, the balance owed, the payments and the payment history.

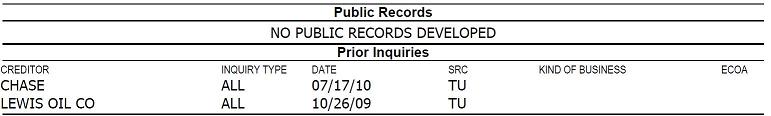

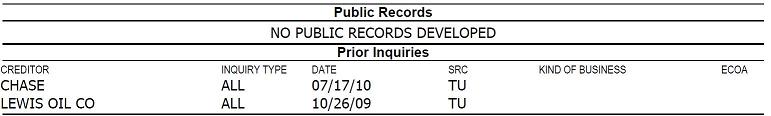

Section 8: Public Records If this section is blank on your prospect's report, that is good. This is where you would find civil cases, such as eviction and other judgments."Inquiries" is a listing of companies or individuals who ran credit reports on the applicant. This section can be used to determine if the applicant has been shopping for loans or special financing such as a car loan.

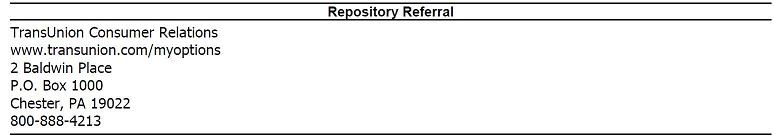

Section 9: Repository Referral is the information needed on an Adverse Action Letter should you reject an applicant for credit reasons. The applicant may use this information to contact the credit bureau for a free copy of their credit report.

For more information on How to read a credit report, please download the

TransUnion Credit Report Guide TransUnion Credit Report Guide

|